TAX BRACKETS 2019 TRIAL

This trial is absolutely free and there are no strings attached.ġ Rev.

You'll get a no-obligation 7-day FREE trial during which you can read all of our helpful tax saving tips from the last two months.

If you are not yet a subscriber, CLICK HERE. If you're already a subscriber to the Tax Reduction Letter, you will be prompted to log in when you CLICK HERE. For tax year 2019, income tax rates are reduced across the board, and in 2023, subject to revenue triggers, nine brackets will be consolidated into four, with the top rate reduced to 6.5 percent. If you can find $10,000 in new deductions, you pocket $2,400. That puts the two of you in the 24 percent federal income tax bracket. You and your spouse have taxable income of $210,000. Why? That’s where you start to pocket cash when you find a new or additional tax deduction.Įxample: You are married. When looking at your federal income tax bracket, pay attention first to your last bracket. Married Individuals Filing Separate Returns (Most of these rates were lowered by the Tax Cuts and Jobs Act of.

TAX BRACKETS 2019 PLUS

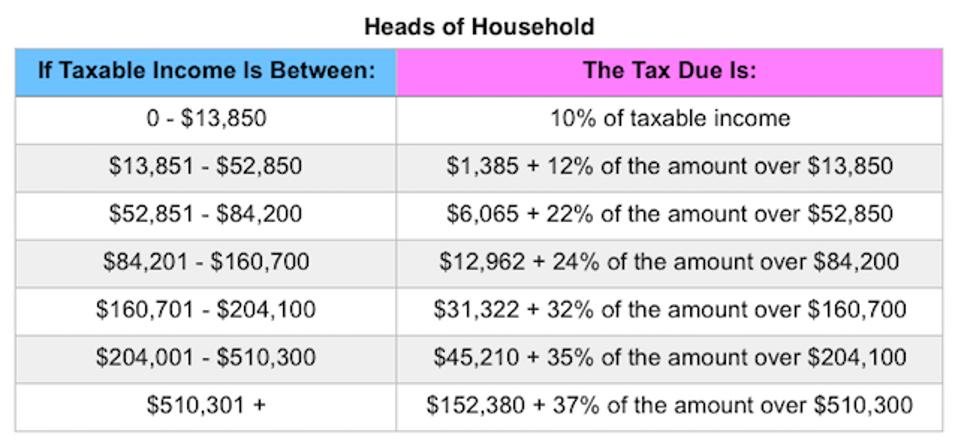

$153,798.50 plus 37% of the excess over $510,300 The 2019 tax rates themselves are the same as the tax rates in effect for the 2018 tax year: 10, 12, 22, 24, 32, 35 and 37. Unmarried Individuals (other than surviving spouses and heads of households) The table below shows how each additional dollar earned gets taxed by the U.S. Ordinary income, dividends, interest and short-term capital gains are taxed at this ordinary income tax rate. $31,322 plus 32% of the excess over $160,700 The United States federal tax laws follow a progressive tax system with 2019-2020 marginal tax rates varying from 10 to 37. Married Individuals Filing Joint Returns, & Surviving Spouses McKinley Plowman are expert tax accountants in Joondalup. If you have any queries related to tax or any other financial services, contact McKinley Plowman today.Find out your 2019 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts. $54,232 plus 45c for each $1 over $180,000Ĭheck your tax with our handy online income tax calculator. Different rates apply to foreign/non-resident individuals, including Working Holiday Makers.įor comparison, here’s the Personal Income Tax Rates Table from 2017-2018: Tax Table The rates apply to Australian resident individual tax payers only. Note: This table does not include the Medicare Levy (currently 2%) or the effect of any Low Income Tax Offset (LITO). See the personal income tax rate tables below. Notably, the old $87,000 tax threshold has been increased to $90,000 while the amount of tax on incomes for the highest two brackets have changed slightly. There were some changes to personal income tax rates and thresholds in the 2018-2019 Federal Budget compared to 2017-2018. Personal income tax rates for Australian residents (2018-2019) Personal income tax rates for Australian residents (2018-2019)

0 kommentar(er)

0 kommentar(er)